Sell My Business! Sell My Business?

Maybe not today or tomorrow, but at some point, you intend to sell your business . Having the end in mind from the beginning with an exit strategy is important. Whether you are simply seeking to gain a deeper understanding of the value of your business for planning purposes, or want to sell yesterday, you have come to the right place. Sixth Sense solutions is part of a brokerage collective that can help you with your exit strategy, consult with top experts, find the best deals and the highest multiple factors.

Please fill out the seller registration form below and we’ll follow up with you to schedule a discovery meeting with us to review your business value and options. We look forward to connecting with you to discuss your business framed in your exit strategy at no cost.

Want to know more about the the top four things to prepare my business for sale? Click below on the preparation for sale button.

What are the top FOUR things to best prepare your Business for Sale?

Achieve Operational Excellence

Proper Stakeholder planning: Shareholders’ needs – legal/tax/operational

Diversification: Payor Sources, referral sources, and lead flow

Create procedures, policies, and automation: Systems and infrastructure

Settle where possible: Clean Operational history – Insurance or legal claims

Make yourself replaceable: Role and level of involvement of owner

Cross train, delegate: Skills & roles of key staff, and their tenure

Find / Attract Buyers

- Who are the potential Buyers for your Business?

- What do Buyers look for?

Individual Buyers

Profiles

Serial entrepreneurs

Owner/operators in same or parallel business

Other adjacent franchise owners (if applicable)

Characteristics

Suited for Main Street deals

Typically look for financing options including SBA financing

Tend to pursue local deals, close to where they live

Strategic Buyers

Profiles

Corporate Buyers looking for vertical or geographic expansion

Could be own Franchisor if business is a franchise

Characteristics

Not suited for franchise resales

Pursue larger main street and lower middle market deals/ deals not necessarily local to them

Private Equity Groups/Financials Buyers/Family Offices

Characteristics

Looking to start a new platform or bolt-on investment

Focused on Return on Investment (ROI)

Not suited for franchise resales

Pursue lower middle market deals/ deals not necessarily local to them

- How to Best Package the Business

- How to Best Position for maximum value

- Create Blind advertising/social media messaging/email campaigns

- Obtain Optimal Buyer vetting

- Access to Collaborative Broker networks

- Proven and Reliable Deal Management Systems

Deal Process– Things to Consider

Due diligence process: can last 15 to 45+ days

Bank loan process: Covered in the next segment

Franchisor approval (If applicable) – Review the Transfer Section of your FA

Inform Franchisor of intent to sell

Pay transfer fee

Bring status to current and sign General Releases

Current Franchise Agreement signed by Buyer

Satisfy all conditions for closing

Secure final franchisor approval

Enable transfer assistance

Buyer Due Diligence (* Some access restrictions need to be negotiated)

Be prepared for Due Diligence in Areas of business operations, quality oversight, financial, legal/operational, HR/employment, and marketing. Examples:

Three years of Profit & Loss & Balance Sheet Statements (plus YTD) and Tax Returns

List of Assets to be included in sale – identify exclusions

Premises Lease and extensions as well as equipment leases

List of liabilities (amounts and payment schedules)

Bank statements for reconciliation

Insurance info (liability/WC)

Payroll reports and other Employee-related data

Customer data and stats

Referral Sources data and stats

Allocation of purchase price – has huge tax implications for Asset Sale

State licensure requirements (as applicable)

Purchase Agreement

A Purchase Agreement typically contains the following segments:

Asset Vs Stock sale

Definitions of Assets being sold

Breakdown of consideration/ Purchase price

Treatment of Account Receivables

Conditions/Contingencies of the Sale

Mutual due diligence completion

Lease transfer or new lease

Buyer bank financing

Licenses/regulatory compliance

Franchisor approval

Description of escrow process and closing target date

Seller Representations and Warranties

Treatment of Prorations, Taxes, & Expenses

Covenant Not to Compete

Governing law and mediation of disputes

Escrow Process– Things to Consider

Pre-Closing Stage

Escrow receives additional funds if stipulated in Agreement

Franchisor transfer process satisfied (If applicable)

Begin the Change of Ownership Process, i.e. license(s)

Seller continues to run the business

Buyer contacts and sets up vendors for services (Insurance, Payroll, etc.)

Refer to Franchise Agreement for post close training obligations (If applicable)

Closing

Everything is in place: Licenses, insurance, funding, franchise agreements, employment of current personnel, operational transition

Franchisor training schedule (If applicable)

SIXTH SENSE SOLUTIONS Affiliation with

our trusted BUSINESS BROKERS

Sixth Sense Solutions strives to add value to our clients through key affiliations and partnerships with industry leaders in various fields. such as with Crossroads Brokers Inc., which aims to provide our clients with access to a valuable resource that can both educate on and execute exit strategies for Business Owners.

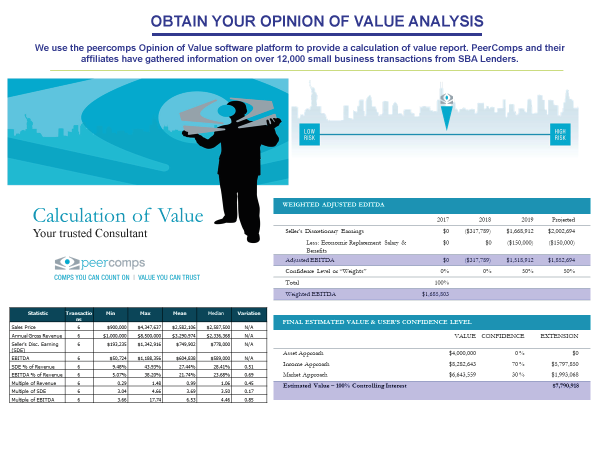

By completing the Seller Registration below, you can gain access to a one-on-one consultation and material that describe how to best prepare your business for sale, as well as receive a complementary Opinion of Value Analysis Report (for Businesses with Revenue > $1MM).

FREE OPINION OF VALUE ANALYSIS

We will perform a more detailed analysis and provide a detailed Opinion of Value report. Please click on the seller registration above

We offer it as a free service for businesses over $1MM in revenue!